Biden Administration Delays Order Blocking Nippon Steel’s Acquisition of US Steel

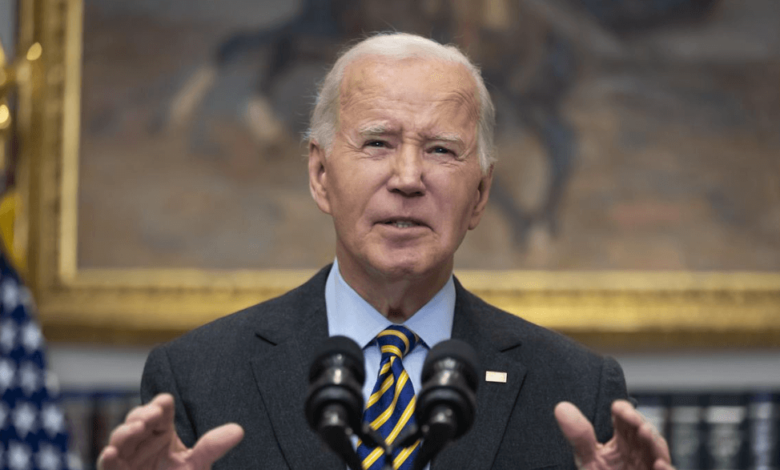

The Biden administration has granted a reprieve to Nippon Steel and US Steel, delaying the enforcement of an executive order that would permanently block the Japanese company’s $14.9 billion acquisition of the American steel giant. The postponement, extending the deadline to June 18, 2025, gives the US legal system time to review a lawsuit brought by the two companies challenging President Joe Biden’s decision.

The extension provides hope for Nippon Steel and US Steel to keep the controversial deal alive, even as political and legal battles intensify.

Backdrop of Biden’s Decision to Block the Deal

On January 3, 2025, President Joe Biden issued an executive order to block the acquisition, citing national security concerns. This followed a lengthy review process by the Committee on Foreign Investment in the United States (CFIUS), chaired by Treasury Secretary Janet Yellen. CFIUS reviews foreign acquisitions of American companies for potential threats to national security, particularly in industries deemed critical to US interests.

Yellen noted that the review involved a “thorough analysis,” but CFIUS failed to reach a consensus on the matter, forcing the final decision into Biden’s hands. His choice to block the deal aligns with a broader strategy of protecting critical industries from foreign ownership, particularly in the steel sector, which has deep ties to defense and infrastructure.

Legal Challenges and Allegations of Bias

In response to Biden’s executive order, Nippon Steel and US Steel filed a lawsuit, alleging that the review process was marred by bias stemming from Biden’s vocal opposition to the deal. The companies argue that this undermined their right to a fair and impartial evaluation.

The lawsuit, filed in a federal appeals court, seeks to overturn the order and secure a fresh review of the merger. The plaintiffs claim that the administration’s stance on the acquisition—expressed even before the CFIUS review began—constituted a prejudgment of the case. They further allege that the decision reflects political calculations rather than genuine security concerns.

Legal experts suggest that this case could set a precedent for how CFIUS handles high-profile acquisitions in the future, particularly involving allies like Japan.

visit: Radamm. com

Political Dynamics: Biden, Trump, and the Steel Industry

The acquisition has become a focal point in the political discourse surrounding industrial policy, national security, and union advocacy. Both President Biden and his successor, Donald Trump, have publicly opposed the deal, underscoring its political sensitivity. The US steel industry is not only a cornerstone of national defense but also a symbol of American industrial power—a fact that has made it a priority for both leaders in courting union voters.

In the lead-up to the 2024 election, Biden framed his opposition to the acquisition as a defense of American jobs and security, mirroring Trump’s promise to block the deal if elected. Trump’s victory in November 2024 means his administration will likely influence the eventual outcome, as he has reiterated his commitment to preventing foreign control of US Steel.

CFIUS and the Unusual Nature of the Case

CFIUS, which evaluates foreign investment for national security risks, rarely recommends blocking deals involving companies from G7 nations like Japan. The panel often seeks to find middle ground, such as imposing conditions on acquisitions to mitigate risks. In this case, however, the failure to reach consensus among CFIUS members highlights the deal’s contentious nature.

The steel industry’s strategic importance—both economically and militarily—was a critical factor in the decision. However, Nippon Steel and US Steel argue that existing safeguards and conditions could have addressed these concerns without outright rejection.

International Repercussions: Strains on US-Japan Relations

Japan has reacted strongly to Biden’s decision, with Foreign Minister Takeshi Iwaya expressing “deep regret” over the move. Speaking on a public broadcaster, Iwaya emphasized the importance of the US-Japan alliance and warned against actions that could disrupt economic and diplomatic ties.

Japan is the largest foreign investor in the United States, with billions of dollars flowing into sectors ranging from technology to manufacturing. Nippon Steel’s acquisition of US Steel was seen as a natural extension of these economic ties, and the decision to block it has created unease within Japan’s business community. Iwaya pledged to continue urging the US to address these concerns, highlighting the broader implications for bilateral relations.

Economic and Strategic Stakes

For Nippon Steel, the acquisition represents a strategic opportunity to expand its global footprint and strengthen its position in the competitive steel market. For US Steel, the deal offers financial stability and access to cutting-edge technology and resources.

The US steel industry, however, remains deeply intertwined with national security. Steel is a critical input for defense manufacturing, infrastructure, and energy sectors, making foreign ownership a sensitive issue. Proponents of Biden’s decision argue that allowing a foreign company to control such a vital industry could expose the US to potential vulnerabilities, including supply chain disruptions.

Critics of the block counter that Nippon Steel, as a Japanese company, poses minimal risk given Japan’s status as a close ally of the United States. They argue that the decision sends a negative signal to foreign investors and could undermine the broader US-Japan alliance.

The Road Ahead

The extension until June 18, 2025, coincides with the expiration date of the acquisition agreement between Nippon Steel and US Steel. This provides a narrow window for the courts to rule on the lawsuit and for the companies to potentially renegotiate terms or address national security concerns.

Several scenarios could unfold:

- Court Overturns Biden’s Order: A favorable ruling for the companies could prompt a fresh CFIUS review, potentially leading to conditional approval.

- Court Upholds the Block: This would likely end the acquisition attempt, though it could provoke further diplomatic fallout.

- Renegotiation: The parties could seek to modify the deal to address security concerns, such as limiting foreign control over sensitive operations.

Conclusion

The Nippon Steel–US Steel acquisition has become a flashpoint in debates over national security, industrial policy, and international diplomacy. The Biden administration’s delay offers a temporary lifeline for the deal, but the outcome remains uncertain amid legal, political, and diplomatic challenges. With a looming deadline, the case underscores the complex interplay between economic globalization and national sovereignty in an era of heightened geopolitical tensions.